Unlocking the

potential of

regional champions

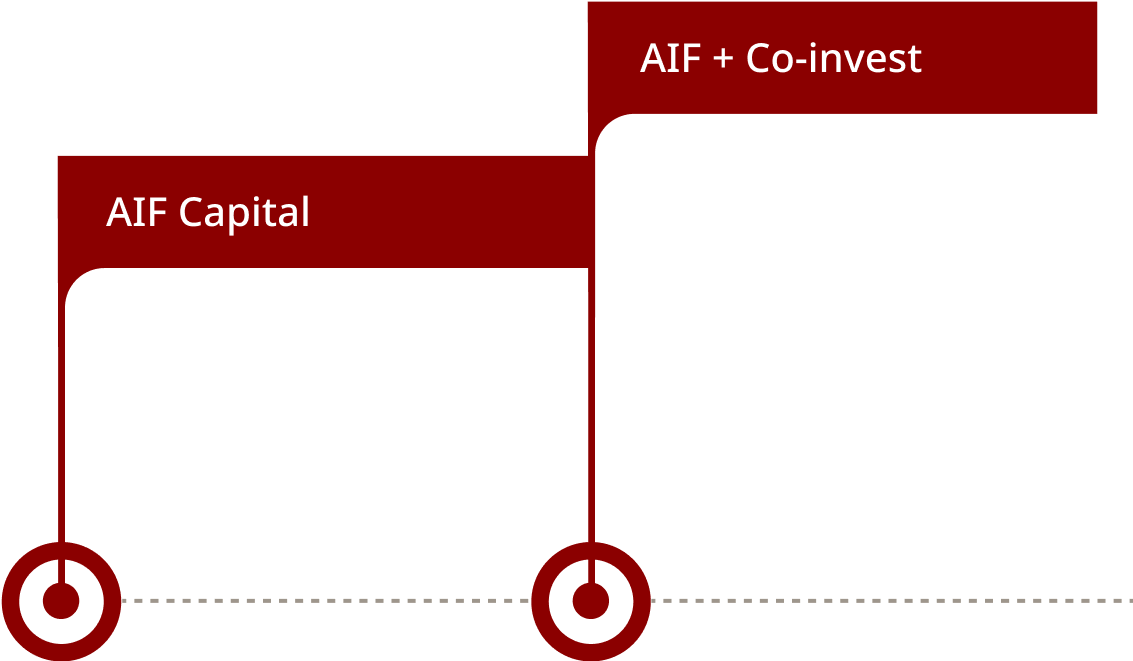

AIF Capital identifies and addresses a funding gap for middle market businesses in Asia. We invest in businesses operating in Asia’s fastest growing areas, which are at critical inflection points and not served by traditional lenders or funding models.

AIF has identified a significant funding gap.

AIF Investment Targets

01

Regional businesses and local market leaders with cross-border expansion needs

02

Seeking transformational growth capital at key points in their development

03

Strong management teams with proven business models

04

Attractive candidates for listing or trade sale in 3-5 years

05

Investment type: Significant minority or control-for-growth

Successful track record implementing ESG strategies since 2006, with 32 investments across nine countries.

AIF Capital is an active signatory to the United Nations-supported Principles of Responsible Investment (“UNPRI”) with a commitment to putting its six principles in practice developed by an international group of institutional investors and with the process convened by the United Nations Secretary-General. AIF Capital was one of the earliest investment managers in Hong Kong to sign the UNPRI.

AIF Capital is a supporter of the Task Force on Climate-Related Financial Disclosures, an organization that promotes effective and clear disclosures of climate-related impacts of Financial and Insurance related investments. This allows investors to clearly understand the concentration of Carbon-related assets in their portfolio’s and their exposure to climate-related risks.

Since 2016, AIF Capital has been given the highest rating (i.e. “Excellent”) on a scale from 1 to 4 from Environmental, Social and Governance reviews conducted annually by LGT Capital Partners (the most recent being 2023) following the criteria and metrics in their 2020 “A guide to ESG implementation in Private Equity”.

AIF Value Creation

01

Strategic guidance

Leveraging our operating advisers and extensive experience

02

Network enhancement

Introduce JV partners and new customers

03

M&A

Support the identification, analysis, and execution of potential targets to expand scale and/or capabilities

04

Operational processes

Share resources and industry best practices to improve operations, infrastructure, and performance measurement

05

Corporate governance

Formalize board and establish committees

06

Talent acquisition

Assist in recruiting, performance management, and incentive alignment of the senior management team

07

ESG

Assist portfolio companies to develop ESG policies and adhere to global best practices

08

Exits

Successful exit experience through public and private markets